VAT

For businesses that are VAT registered, the completion of VAT returns can seem daunting with all the particular rules that apply

However, we can maintain your VAT records, alongside the bookkeeping service, and submit your VAT returns online within the required quarterly deadlines. We will then advise you on the amount of VAT to pay and how to make payment.

Making Tax Digital - If you are registered for VAT and your taxable turnover is above the VAT registration threshold you must keep digital business records and send your VAT returns to HMRC using MTD compatible software. We are able to submit your VAT returns via our Sage MTD software, with the information supplied to us, therefore taking the additional burden away from you

Some of our other services include

Payroll

Payroll is not a task that can be avoided, staff have to be paid and employers are responsible for making the correct deductions for tax and national insurance.

Year End Accounts

All Limited Companies are required to submit to HMRC and to Companies House a set of annual accounts in a specified format by a specified date each year.

Bookkeeping

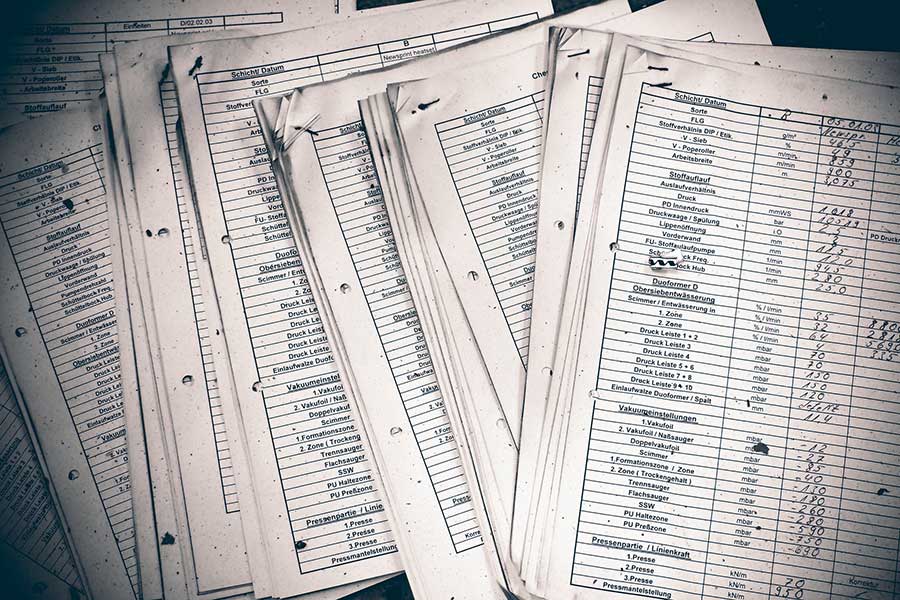

Bookkeeping is a big part of the administration of your business and being efficient and keeping your records up to date is important but is also very time-consuming.